When you think of modern-day retail, you think of Amazon. Its simple and efficient consumer buying experience has propelled it to leadership within the retail space. This retail domination has resulted in its increased influence in changing consumer buying behavior. A perfect example of this influence is Amazon’s Prime Day. Despite the technical difficulties that occurred on the day, consumers still flocked to Amazon to bag those mid-summer sale bargains. Bargains they didn’t even know that they wanted — or needed for that matter — until Amazon dangled the discount cherry in front of them. Not only has Amazon changed consumer buying behavior, they have also changed the behavior of other retailers. Retail giants such as Target, Walmart and Best Buy looked to emulate Amazon’s success through their own mid-summer sales.

When you think of modern-day retail, you think of Amazon. Its simple and efficient consumer buying experience has propelled it to leadership within the retail space. This retail domination has resulted in its increased influence in changing consumer buying behavior. A perfect example of this influence is Amazon’s Prime Day. Despite the technical difficulties that occurred on the day, consumers still flocked to Amazon to bag those mid-summer sale bargains. Bargains they didn’t even know that they wanted — or needed for that matter — until Amazon dangled the discount cherry in front of them. Not only has Amazon changed consumer buying behavior, they have also changed the behavior of other retailers. Retail giants such as Target, Walmart and Best Buy looked to emulate Amazon’s success through their own mid-summer sales.

Changing consumer preferences, the rise of e-commerce and the domination of Amazon have all disrupted the modern day retail industry. With today’s mobile-first consumer, this revolution has meant that understanding the mobile journey is now more important than ever if retailers want a chance at keeping pace with Amazon.

Read More: Amazon’s Prime Day ‘18 Witnessed 3x More Sales Than Usual

Amazon, friend or foe?

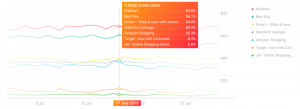

Retailers have a love-hate relationship with the online marketplace giant. Amazon may be dominating the market, but has this domination actually proven to be beneficial to the retail industry as a whole? Prime Day — the mid-summer sales event consumers never knew they wanted, had the potential to put the nail in the retail competition’s coffin but instead it appears that it’s created new opportunities and provided new life to the retail industry. Ogury’s proprietary first-party device-level data shows that daily active app users increased significantly across various retail apps including Walmart, Best Buy and Kmart, beating Amazon in active users on their own Prime Day.

Screenshot of Ogury’s ecosystem intelligence solution, Active Insights: Daily active users

Screenshot of Ogury’s ecosystem intelligence solution, Active Insights: Daily active users

The increased usage of competitor retailer apps on Prime Day suggests that consumers were shopping around, subsequently, increasing opportunities for other retailers. So, is Amazon threatening the retail industry with Prime Day or are they revolutionizing it?

Revolution begins with revelation

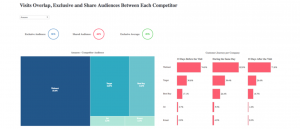

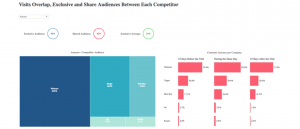

In order to stay competitive and reach consumers during moments of intent, revealing user behavior and understanding the complete mobile journey becomes more and more important to retailers — including Amazon. To ensure this thorough understanding, marketers need to have visibility into both app and web-based behavior. Understanding this will also help marketers to reveal how loyal their customer base is, which in turn will inform their sales strategies. When it came to the mobile web audience share over the month of July, 58% of Amazon’s website visitors were exclusive to Amazon and 42% of their website visitors were shared among the competitor set examined. Looking deeper into these competitor audiences, Amazon shares the largest audience overlap with Walmart, with 35% of Amazon’s website visitors also visiting Walmart’s site, followed by Target at almost 17%.

Screenshot of Ogury’s Insights Hub: Site Journey over July

Screenshot of Ogury’s Insights Hub: Site Journey over July

Nearly 83% of these users who visited both Amazon and Walmart websites did so on the same day, followed again by Target at 39%. This indicates that there is a significant overlap between Walmart and Amazon’s audiences. Digging deeper into Amazon and Walmart’s audiences, demographic data shows that mobile web visits and app owners were spread across all generations, with older age categories showing significant site visits and app ownership across the two retailers, highlighting the powerful opportunity Walmart has with capitalizing on Amazon’s sales calendar.

Yes, Amazon still dominates the retail landscape, but as you can see, Walmart and other retailers are still able to stay competitive. Looking at Prime Day 2017 compared to Prime Day 2018, cross-app ownership increased by 38%. Also, according to Adobe Analytics, retailers with more than $1 billion in revenue saw a 54% increase in sales on Prime Day this year compared with an average Tuesday.

It is clear that Prime Day is paving way for a new future for retail. A future where Black Friday isn’t the kick-off to holiday sales and a single retailer has the power to change consumer shopping behavior. In order to stay competitive in a saturated retail landscape, marketers must keep up with these changing consumer shopping habits by ensuring they understand the entire mobile journey.

Read More: Amazon Prime Air: A New Era of Drone Dominance in Online Retail Distribution

Sources:

- Ogury first-party data

- Adobe Analytics https://www.cnbc.com/2018/07/18/large-retailers-see-more-than-50percent-bump-in-online-sales-on-prime-day.html

Data

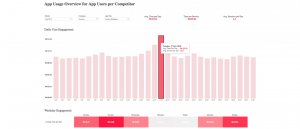

- Sessions per App user

- Despite Amazon’s large footprint, their sessions per user on Prime Day were below Best Buy, Walmart and Kmart.

- Sessions per website visitor

- Amazon app users had an average of 3.9 sessions on Prime day, which was below Best Buy, Walmart and Kmart app users. However, looking at mobile website usage, site visitors averaged 5.3 sessions and beat out key retailers, indicating that Amazon shoppers prefer web.

July

- Time per session

- Looking at time per session, mobile app users were spending less time on Amazon. Jet, Target and Kmart had a higher time per session, indicating that app users were shopping around (or they could just have a less user-friendly app).

App usage

App usage

- Time per session on the 17th, which was the peak of Prime Day, was nearly 5 times (400%) longer than the July average time per session proving that Prime Day was a success for Amazon.

- App owner loyalty

- 73% of Amazon app owners exclusively have the Amazon app and not the 5 other competitors that we examined. This is followed by Walmart at 41%. Want to know who is least loyal? Best Buy. Best Buy shares 90% of their owners with competitors followed by Jet at 85%.

- Amazon exclusive owners are 143% higher than the average in the competitor mix emphasizing their large market share.

- Amazon only shares 27% of their owners with competitors.

- App usage overlap

- Across July, the Amazon app had the highest cross usage with the Walmart app. In fact, 21.9% of users who used the Amazon app also used the Walmart app. This was then followed by Target at 2.4%, which demonstrates that Walmart is far ahead of Amazon’s closest competitor with regards to app usage.

- Let’s dig a little deeper on Walmart and where they’re winning with app usage. When looking at cross-app usage with the competitor set, Amazon is the number one usage overlap except with Walmart and Kmart apps.

- Possession overlap

- Amazon has been dominating the industry for a while now, but Walmart is starting to hold its own. Let’s look at Prime day 2017 compared to Prime Day 2018. Cross-app ownership increased 38% YoY on Prime day. So the question remains, is Amazon’s Prime Day a threat to the retail industry, or is it actually helping retailers? Data proves that YoY more people are engaging with other retailers on Prime Day, so by creating this mid-summer sales extravaganza, Amazon didn’t hurt their competitors. They actually helped them.

Read More: Could Amazon Have Done Better on Prime Day?

July ‘17

July ‘18

Site Journey

- Let’s see what the mobile web audience share looks like. Looking at the month of July, 58% of Amazon’s website visitors were exclusive to Amazon and 42% of their website visitors were shared among the competitor set examined.

- Looking deeper into these competitor audiences, Amazon shares the largest audience overlap with Walmart, with 35% of Amazon’s website visitors also visiting Walmart’s site, followed by Target at almost 17%.

- Nearly 83% of users who visited both Amazon and Walmart websites visited both sites on the same day. This indicates that there is a massive overlap between both retail giants audiences.

Study Sample

- 2,428,237 users

- Data collected between 7/1/2018 and 7/31/2018

- USA only

- Competitors

- Target

- Walmart

- Kmart

- Best Buy

Read More: Why Advertisers Can’t Ignore the Amazon Opportunity