Mobile advertising has traditionally been a difficult sea for publishers and advertisers to navigate. Data from PubMatic’s Q4 2018 Quarterly Mobile Index (QMI) reveals that the mobile advertising ecosystem is carving a smoother path forward and brands and publishers are seeing the benefits of continued investment and the maturing of the channel.

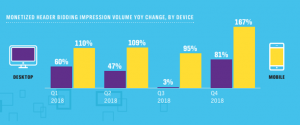

In-App Header Bidding Continued to Experience Growth Across Devices

The inefficiencies of the waterfall and current ad network mediation saw publishers embracing the efficiency and performance of header bidding technology across channels and formats. 2018 was the year header bidding for in-app really took off, with mobile growth rates exceeding desktop by more than 2-to-1, and annual growth rates of 124% for mobile compared with 47% for desktop.

This growth was experienced across all regions, with APAC experiencing the steepest growth curve, increasing 276% YOY, followed EMEA at 191%. Globally, mobile devices now represent 26% of all impressions monetized via header bidding technology.

Advertisers Increasingly Leveraged PMPs to Improve In-App Quality

While web-based publishers are seeing growth in the open exchange, buyers are increasing interest in private marketplaces (PMPs) as a means of accessing safe, premium content and engaged audiences in-app. Quality remains the number one challenge for brands and agencies when it comes to buying in-app. This embraces a fear of fraud, concerns around viewability and brand safety. As a result, in-app PMP impression volumes grew by more than 75% YOY in 2018.

The Entertainment and Leisure vertical experienced the greatest year-over-year growth to become the largest vertical for mobile in-app PMP impression volume in 2018. News, Technology, and Business and Finance trailed close behind.

In-App Video Is Driving Global Mobile Video Growth and Approaching Parity with Desktop

Ad spend in in-app environments experienced growth of over 200% year on year in 2018 to encompass nearly two-thirds of all mobile video ad spend globally.

According to research from Forrester Consulting, more than half of media buyers said that in-app video offers better audience targeting (56%) and more effective customer engagement (54%).

The result is that mobile’s share of global video ad spend reached 47% in 2018, up from 17% in 2017.

In Q4 2018, the biggest spend quarter of the year, mobile devices accounted for more than half of all video ad spend, with a share of 56%, up from 19% year prior.

Having found its feet in 2018, the mobile advertising industry is set to continue to flourish in 2019. Marketers’ budgets are following consumer behavior, which is becoming increasingly mobile-first. While challenges exist around quality and fraud, the industry is beginning to develop solutions to address this. The IAB’s Open Measurement SDK, launched last year, makes it easy to implement and manage multiple viewability and verification solutions. IAB Tech Labs will soon be introduction app-ads.txt , which will allows buyers to confidently purchase mobile apps, as well as over-the-top (OTT) video apps, through approved seller accounts. Such developments help bring greater transparency, trust and confidence which will result in increased investment for in-app advertising. Going forward, the industry needs to continue to focus on quality and education in order to cement mobile as the truly dominant channel for online.

Comments are closed.