MOLOCO’s data report predicts impressive post-pandemic rebounds for mobile app categories hit hardest by lockdown measures

The mobile ecosystem changed dramatically as people reinvented their routines at the start of the pandemic. Now that COVID-19 restrictions are being lifted and vaccine distribution is picking up around the world, mobile app marketers need to prepare for an equally dramatic shift in 2021 and beyond.

At MOLOCO, we wanted to better understand the ongoing effects of the events of 2020 in order to anticipate the impact lifting lockdowns would have on app engagement in the near and far future. That’s why we set out to monitor mobile ad rates across the programmatic advertising ecosystem, analyzing over 100 million bid requests across various app store categories.

The resulting Mobile Life After Lockdown report looks closely at bid request data to paint a picture of how the pandemic affected app engagement and what engagement trends are down the road in a post-COVID world. Specifically, we analyzed data from Australia’s relatively clear cut COVID-19 timeline in the interest of better understanding how mobile engagement changes in response to prolonged restrictions like those seen in the country’s major cities.

Marketing Technology News: MarTech Interview with Dmitri Lisitski, Co-founder and CEO at Influ2

Lockdowns Limited Apps Focused on Face-to-face Connection

It’s no surprise that app engagement skyrocketed when the pandemic began. As people were forced inside their homes, they turned to their devices to shop, connect, work, play, and navigate the unfamiliar challenges of life in quarantine. This reliance on apps reflected changing behaviors worldwide, and it also led to dramatic increases in overall bid request volumes.

While the early months of 2020 followed predictable seasonal trends, lockdown protocols led to increased organic acquisition, IAP spending, and in-app ad revenue. The data we collected shows that during lockdown periods, overall daily bid requests increased by an average of 37%.

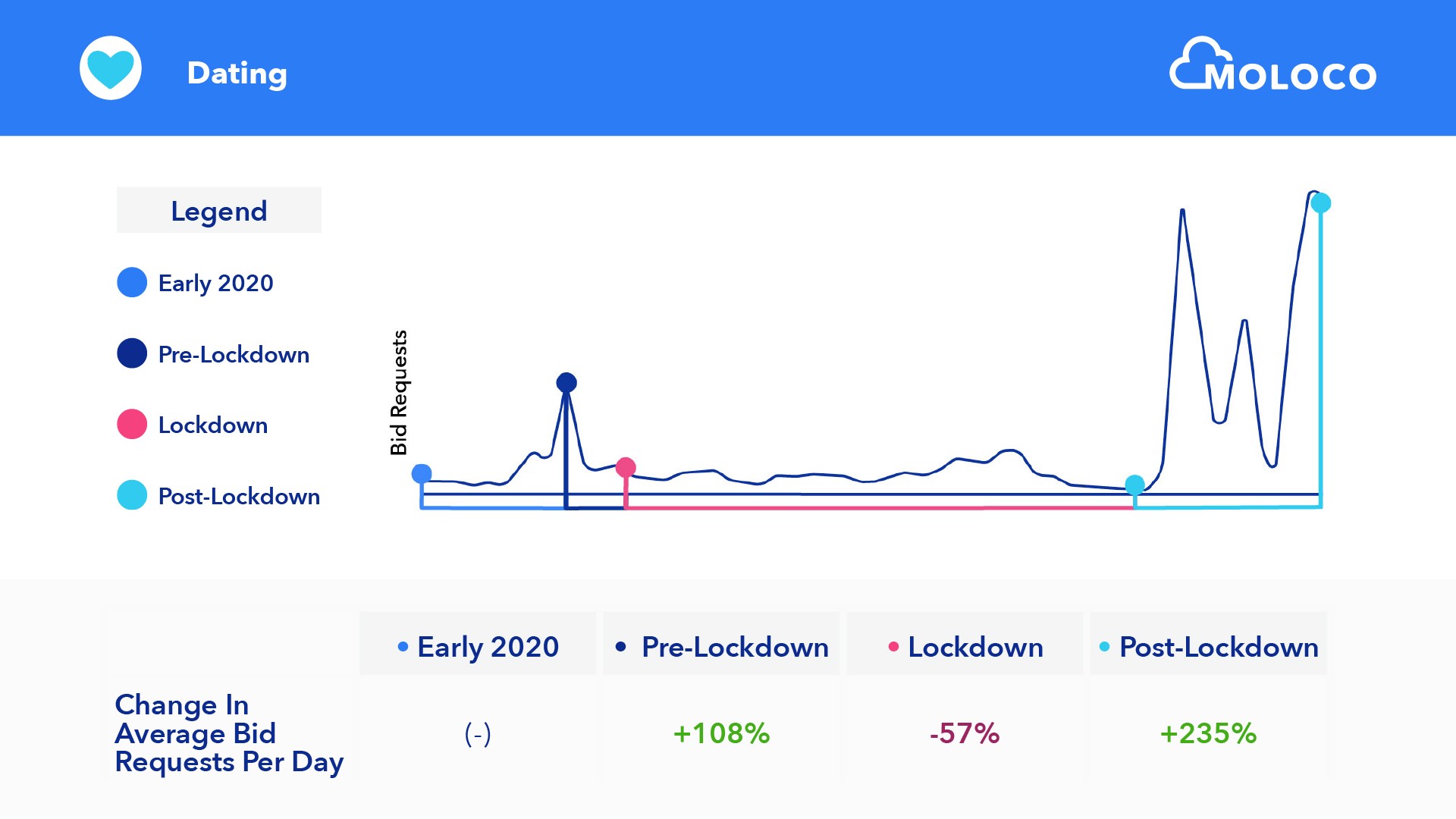

But not all app categories were affected equally. Dating apps saw an average daily bid request increase of 108% in the pre-lockdown period of March 2020, perhaps as people realized their ability to date and connect in person would soon be curtailed. From April to October, average bid requests fell by 57%.

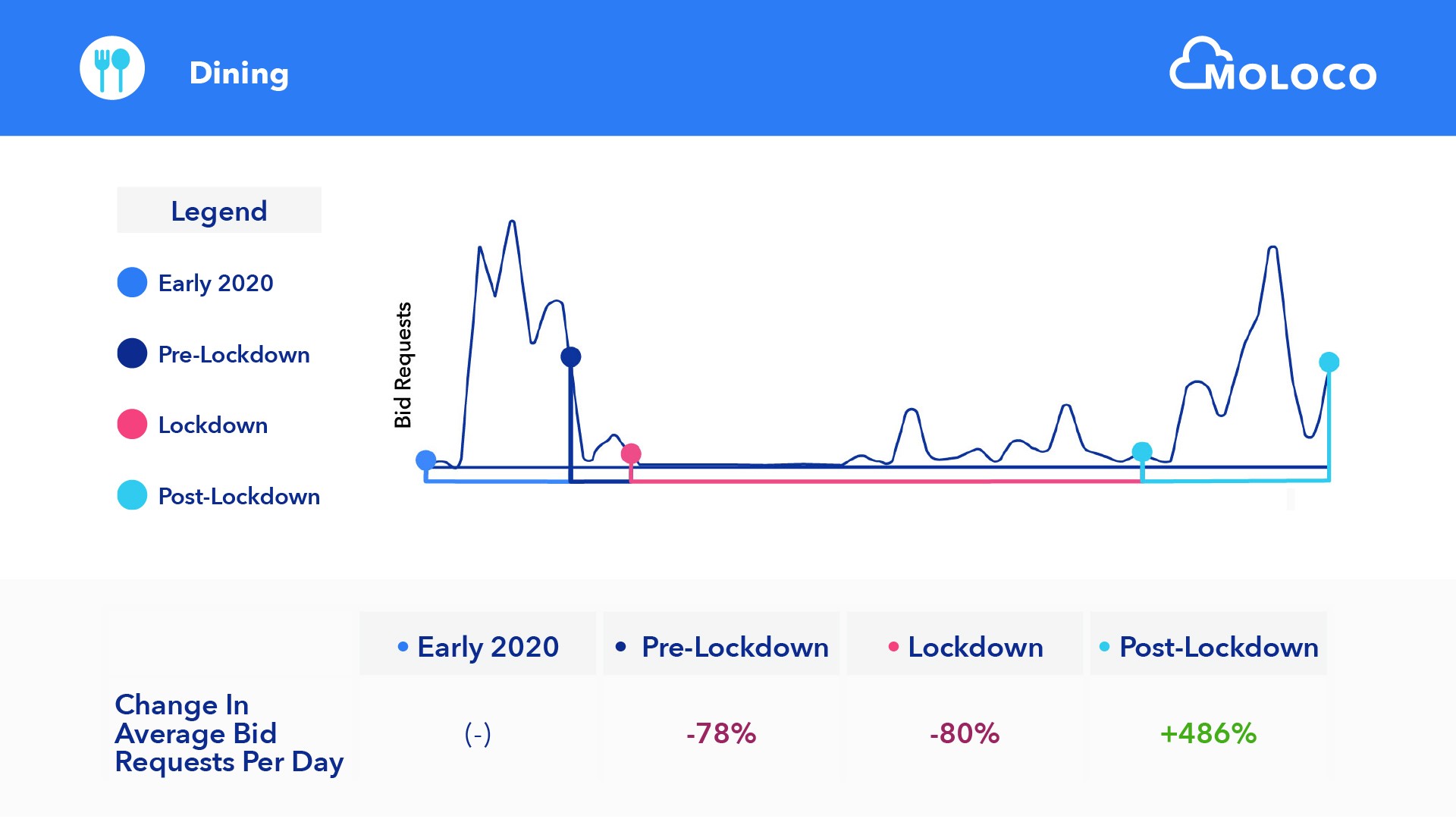

While food delivery apps saw a huge increase in engagement, restaurant-specific apps and apps that cater to in-person diners were hit hard during the height of the pandemic. In March 2020, dining apps saw a 78% decline in bid request volume. That decline grew even further from April to October, leading to an 80% bid request volume decrease on average.

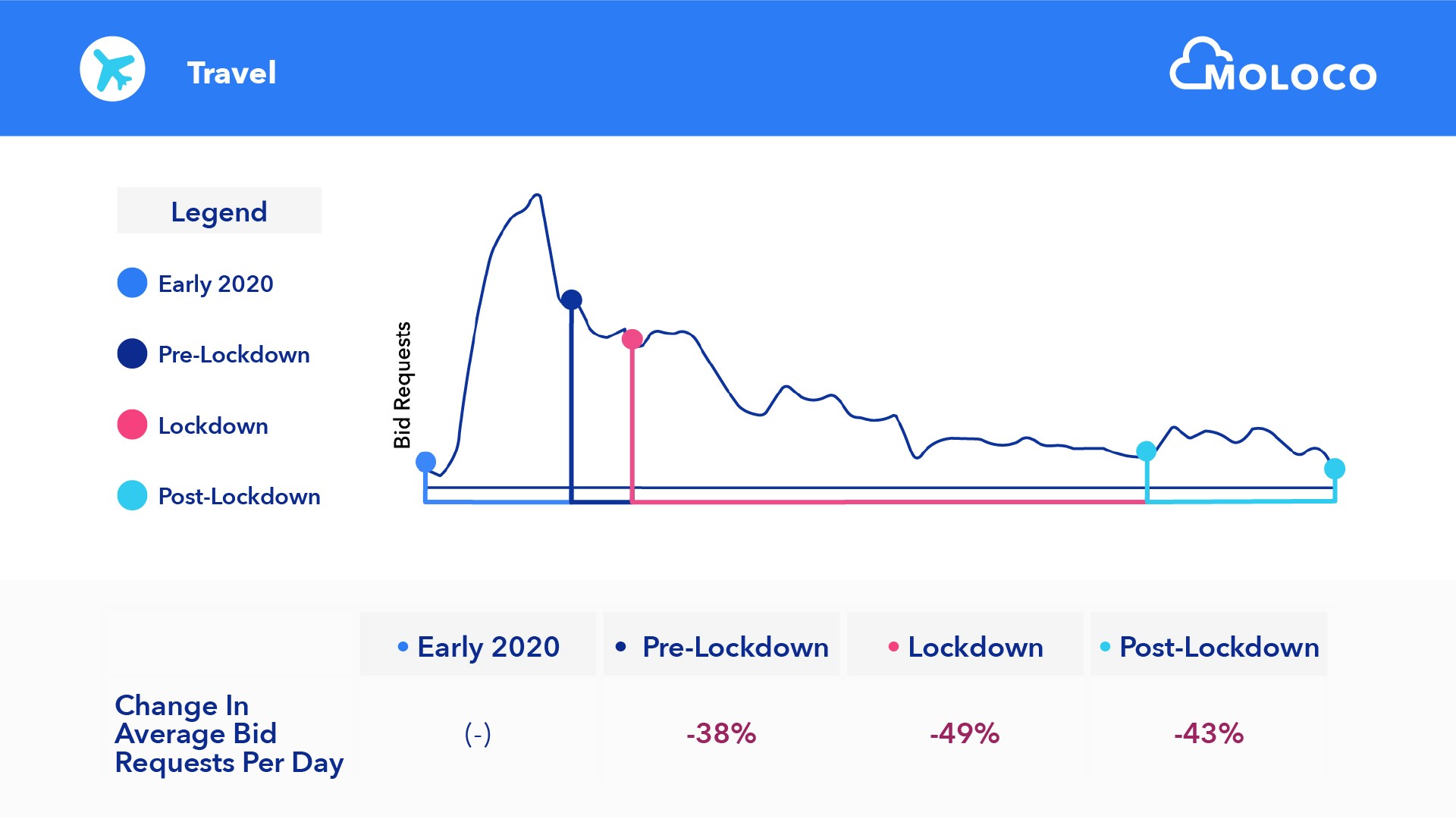

The decline in travel app engagement was more gradual, but it remained consistent across the pre-pandemic period and full-lockdown months. April to October showed a 49% average decrease in bid request volume in the travel app category. But because some travel apps were able to help facilitate safe local travel (like road trips and staycations) as the year went on, the category didn’t bottom out completely.

The decline in travel app engagement was more gradual, but it remained consistent across the pre-pandemic period and full-lockdown months. April to October showed a 49% average decrease in bid request volume in the travel app category. But because some travel apps were able to help facilitate safe local travel (like road trips and staycations) as the year went on, the category didn’t bottom out completely.

At the same time, engagement in some app categories actually benefited from lockdown conditions. Gaming, for example, became a crucial form of entertainment for people of all ages who found themselves suddenly stuck inside their homes. During March 2020, bid request volume increased by a modest 10%. But during peak pandemic months, that increase jumped to an average of 434%. By the time lockdowns ended, average daily bid request volume had nearly doubled its early 2020 levels.

At the same time, engagement in some app categories actually benefited from lockdown conditions. Gaming, for example, became a crucial form of entertainment for people of all ages who found themselves suddenly stuck inside their homes. During March 2020, bid request volume increased by a modest 10%. But during peak pandemic months, that increase jumped to an average of 434%. By the time lockdowns ended, average daily bid request volume had nearly doubled its early 2020 levels.

Marketing Technology News: MarTech Video Interview With Robert Glazer, Founder And CEO At Acceleration Partners

Predicting App Engagement In A Post-pandemic World

Although some app categories saw shattering decreases in engagement during the height of the pandemic, most later boomed as lockdown restrictions were lifted. After many months of isolation, dating apps saw a 235% increase in average daily bid request volume from November 2020 to January 2021. The spike surpassed pre-pandemic dating app usage levels, and the trend is expected to continue as dating apps help facilitate a return to normal social interaction.

Out-of-home dining apps saw a 486% increase in bid requests since lockdowns were first lifted, courting a new normal that could mirror and even exceed pre-pandemic levels as we move throughout 2021. On top of mobile gaming’s over 400% increase during peak pandemic months, bid request volumes continued to grow by 56% during the post-pandemic period. It’s safe to assume that many mobile game apps will retain the new users they acquired during lockdown, carrying a 200-400% average increase into our new normal.

While dating, dining, and gaming apps are all likely to settle at higher engagement levels than before the pandemic, the travel app category has a steeper hill to climb. Even as local restrictions were lifted between November 2020 and January 2021, bid request volume never fully recovered from its decline during the lockdown period. Seasonality will come into play as the category continues to claw its way back, but even warmer weather won’t be enough to immediately restore travel app engagement to pre-pandemic levels. The category’s recovery is likely to continue to grow slowly but consistently as vaccination takes hold, variants come under control, and international borders reopen.

2021 Is the Right Time to Invest in Programmatic Advertising

We understand by now that reopening communities and economies around the world will be a gradual process of trial and error. That said, the overarching trend toward a mobile-first future started long before the COVID-19 pandemic and, as the report shows, will continue long after it. Mobile app publishers—especially those whose categories have benefited from climbing engagement trends—should leverage their strong positioning to invest in retention and remarketing in 2021.

We sourced all the data included in the report from the MOLOCO Cloud automated mobile ad buying platform, which helps mobile marketers tap into the power of the programmatic advertising ecosystem. MOLOCO Cloud leverages proprietary machine learning algorithms to maximize campaign performance and simultaneously offers control over programmatic advertising operations. That enables mobile marketers to evolve and adapt to the ever-changing post-pandemic landscape, while following a proven path toward positive returns on programmatic ad spend throughout 2021 and beyond.

Marketing Technology News: MarTech Interview with Ramon Kania, Chief Technology Officer at Mitto