Company Targets Double-Digit Compound Annual Revenue Growth, Increased Profitability and Strong Free Cash Flow through 2024

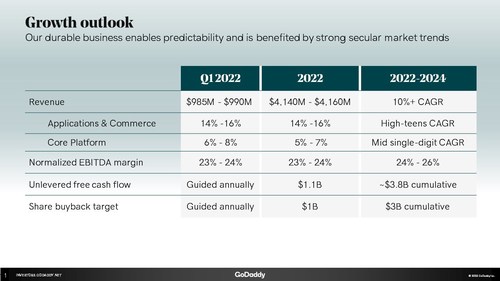

GoDaddy Inc. hosted a virtual investor day today providing insights on how its strategy empowers customers to succeed throughout the entrepreneur’s journey by creating connections between digital identity, ubiquitous presence and connected commerce products. Within its presentations, GoDaddy provided guidance for the company’s revenue, normalized Earnings Before Income Taxes Depreciation and Amortization (EBITDA) and unlevered free cash flow for first quarter 2022, full year 2022 and through full year 2024. The company also outlined multiple ways it expects to grow shareholder value, including a Board-approved multi-year share repurchase target of $3 billion of its Class A common stock. As a part of this target, the company intends to launch a $750 million accelerated share repurchase in the first quarter of 2022.

Marketing Technology News: MarTech Interview with Rick Kelly, CPO at Fuel Cycle

“Our mission to empower entrepreneurs everywhere, making opportunity more inclusive for all, is more relevant today than ever before,” said Aman Bhutani, CEO of GoDaddy. “Online presence and omnicommerce are examples of secular trends where entrepreneurs need GoDaddy’s help to seamlessly offer their products and services both online and in-store. Our more than 21 million customers count on us for technology supported by sage customer guidance, and our focus will remain on helping them thrive in a changing world.”

GoDaddy Investor Day Highlights

Customer and Product Strategy

GoDaddy is an industry leader and intends to create shareholder value by leveraging its unique assets and expanding portfolio to provide a one-stop shop for everyday entrepreneurs. At the core of this strategy is seamlessly connecting customers’ digital identity and ubiquitous presence as well as building out the company’s connected commerce solution.

GoDaddy continues to attract new customers and believes it can increase engagement with its current loyal base of more than 21 million customers by attaching more products through integrated, industry-leading solutions for small and mid-sized businesses. As more new and current customers use these integrated offerings, GoDaddy expects ARPU (Average Revenue Per User) and lifetime revenue to grow.

Additional details were provided during the presentations on how the company’s strong brand awareness, commerce-focused solutions, efficient marketing spend and dedicated Care team provide competitive advantages to accelerate this strategy.

Marketing Technology News: US Hyperscalers Set Cloud Revenue and CAPEX Records in 4Q21

Introducing New Revenue Pillars

To assist the financial community in better understanding and tracking the company’s progress for GoDaddy’s growth-focused areas, the company introduced two new revenue pillars. These new revenue pillars, along with corresponding financial metrics and financial targets, will be reported on going forward.

The new revenue pillars are:

- Applications & Commerce – includes GoDaddy’s create and grow proprietary software, such as websites, list marketing, Managed WordPress and connected commerce solution launched late last year. This pillar also includes productivity applications, such as email. This pillar represented 30% of GoDaddy’s total 2021 revenue.

- Core Platform – comprises primary domain registration – both on the registry and registrar side – aftermarket, hosting and security solutions. This pillar represented 70% of GoDaddy’s total 2021 revenue.

Capital Allocation Strategy

As part of its capital allocation strategy, the company emphasized its balanced approach focused on unlocking meaningful value creation by further investing to grow the business, while returning capital to shareholders. GoDaddy management discussed its authorization to repurchase $3 billion of its Class A common stock over the next three years and disclosed that approximately 80% of the company’s free cash flow is intended for stock repurchase efforts. This underscores its goal of growing shareholder value and returning excess cash to shareholders, while maintaining the ability to invest for growth.

Three-year Financial Targets

GoDaddy provided new three-year financial targets to help investors and analysts model its business over the longer term. As part of this guidance through 2024, the company expects:

- 10% or greater top line revenue compound annual growth rate (CAGR); this includes estimated revenue of more than $10 billion from existing customer cohorts over the next three years

- 24% – 26% range for normalized (EBITDA) margin

- Approximately $3.8 billion cumulative unlevered free cash flow

- $3 billion share buyback target

Marketing Technology News: Why Intra-Video Metadata is the Missing Piece of the CTV Pie