One relationship that has dominated our discussions of marketing leadership for the past 15 years is that between Marketing and Sales. So, what actually CMO and CFO share amongst each other to get the business run like a fine machine? How is this relationship critical to Marketing Performance Management?

Today, in an age where marketing investments are under greater scrutiny than ever, and when CMOs are held accountable for their ability to deliver revenue, it’s time to focus on the relationship between Marketing and Finance. This overlooked partnership matters – not only because Finance holds the purse strings, but also because the CFO continues to take on a much more strategic role in organizations.

In a perfect world

Our team at Allocadia recently published an empirical study on the topic of Marketing Performance Management (MPM) – a practice that includes planning, budgeting, and measuring results of marketing investment. We collected responses from over 200 organizations across 13 industries, spanning an equal number of B2B and B2C participants. 30% represented revenues of over $1 Billion, and nearly half have revenue over $200 Million.

We found that companies who excel at MPM expect their marketing budgets to increase, see significant revenue growth (at least 10%+ YoY), and have a higher confidence in their return on marketing investment than the average marketing department.

Alignment between Marketing and Finance is one of the key characteristics of high-performing organizations. These companies with well-optimized MPM practices ensure that Finance is a trusted strategic partner to marketing and sales. Their departments are aligned on market expectations and work to create predictable expenses and revenue.

The gap between CMO + CFO

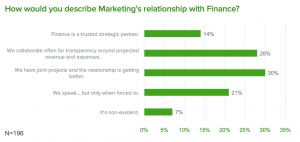

The study uncovered a major alignment problem in the industry. Only 14% of Marketing organizations in our study see Finance as a trusted strategic partner and 28% either have no relationship with Finance, or speak only when forced to.

This could be a highly influential ally for a Marketer, one who could provide more power, flexibility, and a stronger voice within an organization’s leadership team. However, if the CFO sees Marketing as a cost center, the result is likely budget cuts, rather than budget increases.

Benefits of alignment

In contrast, high-growth organizations are 3X more likely to align Marketing and Finance, underscoring the importance of maintaining this alliance.

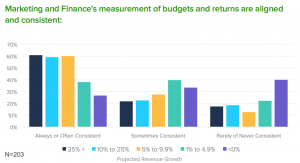

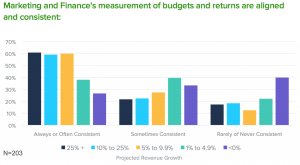

These organizations align on investment tracking, measurement, budgeting, and returns. 57% of organizations expecting 25%+ revenue growth report that Marketing and Finance often or always work well together to track investments and measurements, compared to only 20% of companies expecting flat or negative growth.

Getting onto the same page about processes and approaches is also important between Marketing and Finance. Marketing organizations that expect larger revenue growth report significantly better alignment.

In the figure above, 61% of companies expecting 25%+ growth report consistent (often or always) alignment with Finance on the measurement of budgets and returns. Those expecting flat to negative growth report the same only 27% of the time.

The most successful marketing departments forge a strong partnership hereto maximize their resources and demonstrate their continued impact. 40% of companies experiencing flat to negative growth say they are rarely, or not at all consistent with Finance in their reporting. Finally, well over 50% of organizations expecting revenue increases of 10% or more have a strong relationship with Finance.

Next steps:

- If you don’t have a strong relationship with a Finance counterpart, make this a priority today. Whether that be the CFO, the head of FP&A, or one of their lieutenants, find someone. They can help you with everything related to investments and results.

- Bring Finance into your planning and budgeting process. This may seem counterintuitive at times, but Finance values predictability over anything else. If they understand how much and where Marketing is going to spend, they will be more comfortable. If they start to gain trust in your projections, they will give you the opportunity to test and try much more.

- Discuss Marketing’s measurement practices with Finance, as well as how Marketing Performance will be judged. Again, Finance likes predictability, so set expectations of what success looks like, then update as progress is made, or as changes happen. This will provide Finance with an important view that elicits trust. When this trust is gained, they will look at Marketing as a strategic partner – rather than cost center.

Finance is responsible for understanding business results (and what results will be) in addition to who is responsible for what. If a CMO wants credit for Marketing’s contribution to revenue, they must form a strong bond with the CFO, set expectations of what marketing success looks like, and work closely with the CFO to gain their trust.

The full report is available at http://content.allocadia.com/ebooks/2017-mpm-maturity-benchmarking-report.