More of an FYI, already into Amazon Prime Day 2019, we are on the eve of what has grown to become one of the biggest shopping moments of the year across on and offline retail. What can we expect to see this time in the US E-Commerce industry? Guided by last year’s numbers, here are some of Nielsen’s Prime Day predictions.

Justin Belgiano, Senior Vice President of Consumer Data Practice, Nielsen, said –

“The stage has been set for a Prime Day where health & beauty and grocery will dominate–and omni-channel competition will reach new heights. Success will come to those who capitalize on these hugely popular categories that have previously under-performed on Prime Day–while ensuring that the best promotions also appear in stores, not just online.”

NIELSEN’S PRIME DAY PREDICTIONS

Nielsen’s Total U.S. e-commerce measurement powered by Rakuten Intelligence, July 2018 – reflecting Amazon Prime data specifically

GROCERY OVER GADGETS:

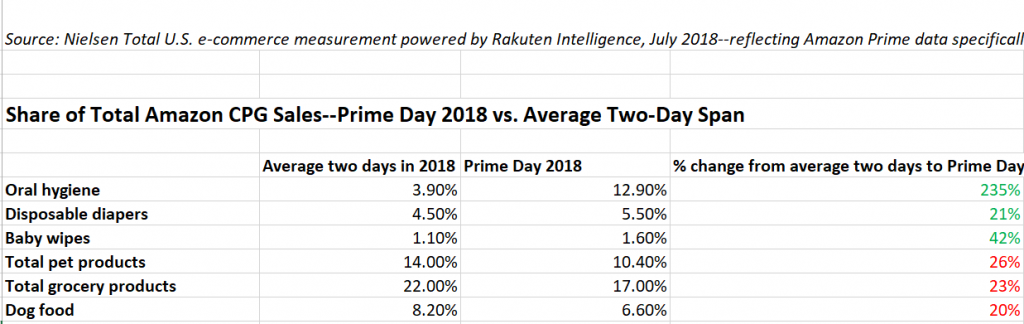

What started out as a moment to score deals on gadgety goods has quickly expanded and transformed to become a blitz to buy goods of all types. In fact, last year, Amazon doubled its consumer packaged goods (CPG) Sales for Prime Day compared to an average two-day span. CPG Sales compared to Prime Day 2017 saw a +20% increase.

Keep an eye on: Grocery. Within CPG Sales, last year grocery was the second-highest category behind health and beauty, accounting for 17% of total Amazon CPG Sales on Prime Day. Consumers continue to warm up to the idea of grocery shopping online – more than ever before, consumers will have a stronger appetite this year to take advantage of grocery deals.

BEAUTY AND BABY CARE BASICS DOMINATE, WHILE PET LACKS BITE:

Keep an eye on: This year, keep a close eye on the performance of health and beauty categories, as it may prove to see an even bigger moment in the Prime Day spotlight.

In 2018, health and beauty topped CPG Sales, with consumers sopping up deals on beauty care basics. Oral hygiene items (like electric toothbrushes) accounted for 12.9% of total Prime Day 2018 CPG Sales, compared to 3.9% over an average two-day span (+235%).

Within baby care, In 2018, disposable diapers accounted for 5.5% of total Prime Day 2018 Sales, seeing a (+21%) surge compared to the rest of the year. Baby wipes accounted for 1.6% of Prime Day 2018 Sales, compared to 1.1% the rest of the year (+42%).

That said, it’s interesting to note that the pet category, which is one of the most evolved CPG categories within the online space, has historically been relatively silent during this retail holiday – with no major pet retailer offering competitive deals or promotions during this time. When it comes to Sales, pet products accounted for a 10.4% share on Prime Day, which is a decline in what is usually seen on an average two-week basis (-26%). Dog food also saw a decline in sales share (-20%).

Is Prime Day not CPG pet-friendly? Or, is this a missed opportunity for the players in the pet space?

THE SHIFT FROM ONLINE TO OMNICHANNEL WILL BE A MIXED BAG OF SUCCESS + FAILURE

In the same breadth, Neil Michel, Associate Director at Accenture Interactive, spoke to us about the role of AI in E-Commerce. “At Accenture Interactive we see AI poised to take the retail sector by storm. Years of investment and experimentation have produced some very relevant AI solutions that touch the entire retail value chain – from the supply chain to merchandising to marketing and customer engagement.”

Neil added, “Product Recommendations and Content Personalization is where we see AI really shining. These applications require less human-to-robot interaction and put the core value of AI (is computational power) behind a user interface like a website, email, chat, or digital advertisement. In these applications, we see AI finally achieving the kind of relevancy consumers appreciate.”

Nielsen’s predictions continues.

The race for omnichannel grocery supremacy is already tightening between Amazon and traditional brick-and-mortar. With Amazon adding incentives for Prime members to shop at Whole Foods, and Walmart’s prevailing strength in online grocery, omnichannel grocery deals will play an even bigger role this year.

Keep an eye on: Amazon competitors and other players. This will be the most competitive Prime Day ever – and other retailers will capture Prime Day’s Halo Effect both online and in-store. According to Nielsen’s Connect Partner, CommerceIQ, more than 250 retailers are planning deals – and with good reason. Some CPG retailers who have taken advantage of the Prime Day Halo have benefited. For example, Target tripled more than their average CPG Sales on Prime Day 2018 compared to an average 2 day span over the course of 2018.

That said, winning omnichannel is still anyone’s game.

WILL 2019 BE PRIME TIME FOR BRANDED PRODUCTS OR PRIVATE LABEL?

On Prime Day 2018, CPG private label accounted for a mere 1% of Sales for Amazon. This represents a detour from the broader progression toward CPG private label, which accounts for 3% of total online dollar sales.

Keep an eye out: Amazon’s concerted push over the last year may begin to tip the scales – making 2019 the year that online private label ascends.