There’s been a lot of change in mobile app marketing over the past few years. In fact, change is in this industry’s DNA. The rise of generative AI has posed questions about the future of creative production. Mobile gaming growth has slowed despite its ongoing dominance, while consumer apps have accelerated. Finally, social media and video streaming apps have really come into their own, even as Meta and TikTok face regulatory challenges in key markets.

Amid the current uncertainty, Liftoff’s 2025 App Marketer Survey sheds light on where the industry is headed—through the lens of marketers themselves. Created in collaboration with Sensor Tower and AppsFlyer, this report combines feedback from more than 700 mobile marketers worldwide to provide a snapshot of the successes, challenges, and expectations that set the table for this year.

The shifting balance between games and apps

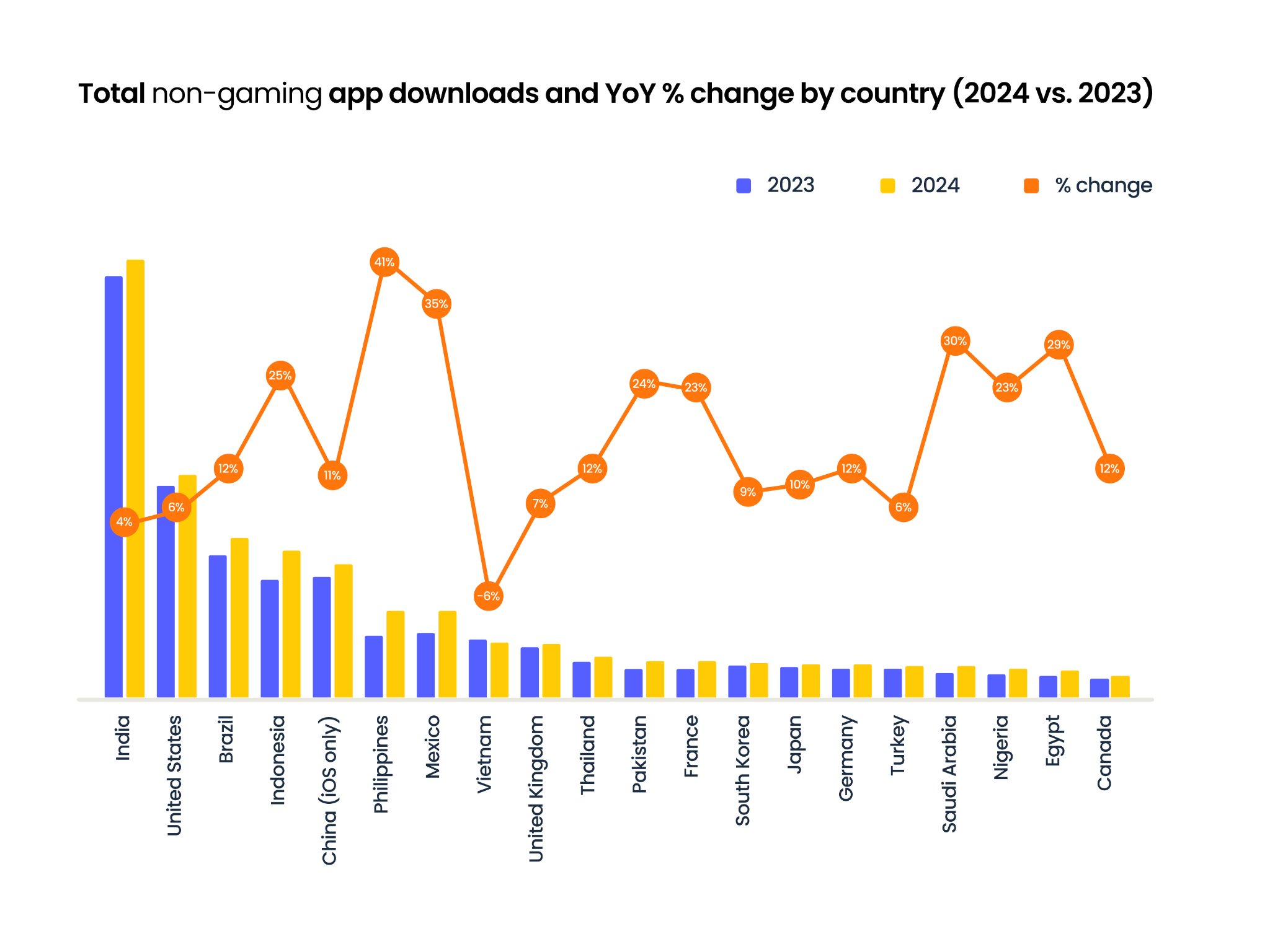

The growth of non-gaming consumer apps has been an ongoing story across the mobile app industry for the past two years, and the report finds that the trend has only continued to get stronger. According to AppsFlyer, non-gaming app categories saw a striking 12% increase in downloads over the past year, while Sensor Tower found that users spent 4.2 trillion hours in apps (about 500 hours on average for everyone on Earth).

As one would expect, increased users means increased revenue. Total spending grew $13.7 billion year-over-year from 2023 to 2024, suggesting apps will soon surpass mobile games in their share of total consumer spend. Entertainment apps are especially popular, with Sensor Tower finding that users spent over $4.4 billion more than in 2023—an increase over twice that of other high-growth categories like photo and video, productivity, and social networking.

Meanwhile, mobile game growth remained relatively flat year-over-year. Tier-one markets like the US and Japan saw minor dips of less than 5% in downloads while emerging markets like Mexico and the Philippines gained around 5%. Looking at revenue, mobile game app categories saw a slight 1% decline in 2024 overall. Certain gaming apps were impacted worse than others, with casual titles seeing a bigger drop of 5%.

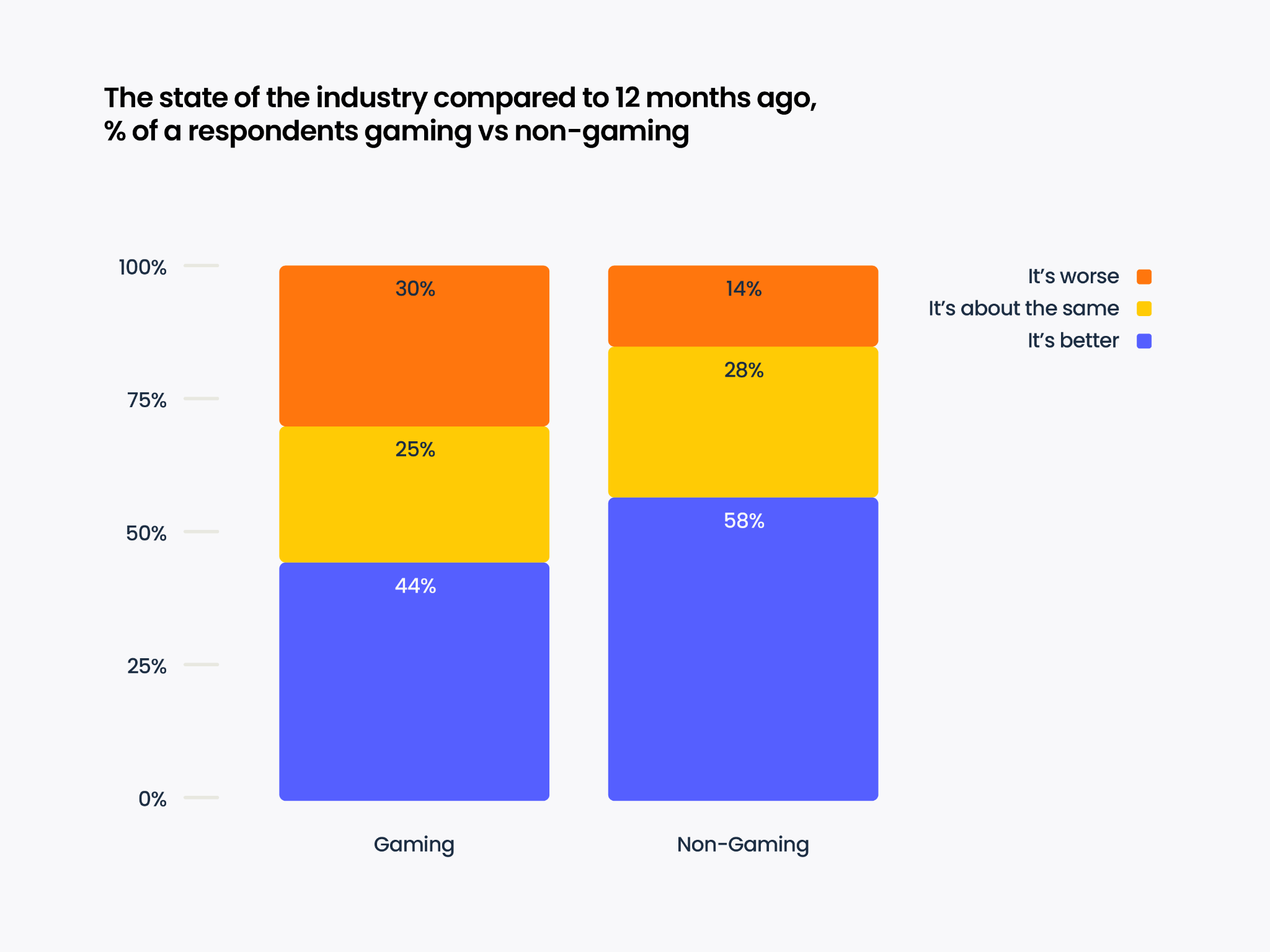

The difference between the gaming and non-gaming categories of the mobile app market is also reflected in the industry sentiment. The survey found that 30% of marketers believe the gaming app industry is in a worse place than it was 12 months ago, although 44% felt it’s doing better. Comparatively, just 14% thought the non-gaming app industry has declined, with 58% stating they’d seen an improvement.

App marketers aim for more aggressive KPIs

Regarding the overall picture, the survey indicates that most marketers are being pressured to deliver consistent growth, with over half of all respondents reporting more aggressive KPI targets for 2025. Given the difference in their trajectories, it is unsurprising that non-gaming marketers face tougher targets than their gaming counterparts at 61% versus 4%, respectively.

Even so, most marketers are meeting expectations, with 90% of all respondents stating they are close to reaching their targets. One reason for the ongoing success is that many marketers have been granted ample resources. Nearly half of survey respondents reported working with a larger (or significantly larger) budget than 12 months prior. Interestingly, companies with budgets over $1M reported the most significant increases, suggesting resource-rich firms are strengthening their market position.

So, what are marketers striving for in 2025? According to the survey, around 80% see increasing revenue as their top priority. That’s not too surprising. External investments have become more selective, causing the growth-at-all-costs models to disappear. As a result, sustainable growth is now at the top of many people’s minds.

Interestingly, 27% of respondents identified brand awareness and loyalty as their top goals—particularly those in education, finance, and food & drink apps, where reputation and long-term engagement are critical to success. It’s a reminder that marketing priorities can vary significantly by app category, depending on user behavior and business model.

Marketing Technology News: MarTech Interview with Becca Toth, CMO @ Hyland

Technology and developments

The past year has brought a wave of new technologies and platforms, and the survey offers a look at how mobile marketers are adapting. One of the most significant developments was Apple’s release of the AdAttributionKit (AAK), a framework that enables broader ad attribution capabilities while addressing privacy requirements across multiple markets. The survey suggests it’s been well received, with 67% of respondents citing at least some familiarity.

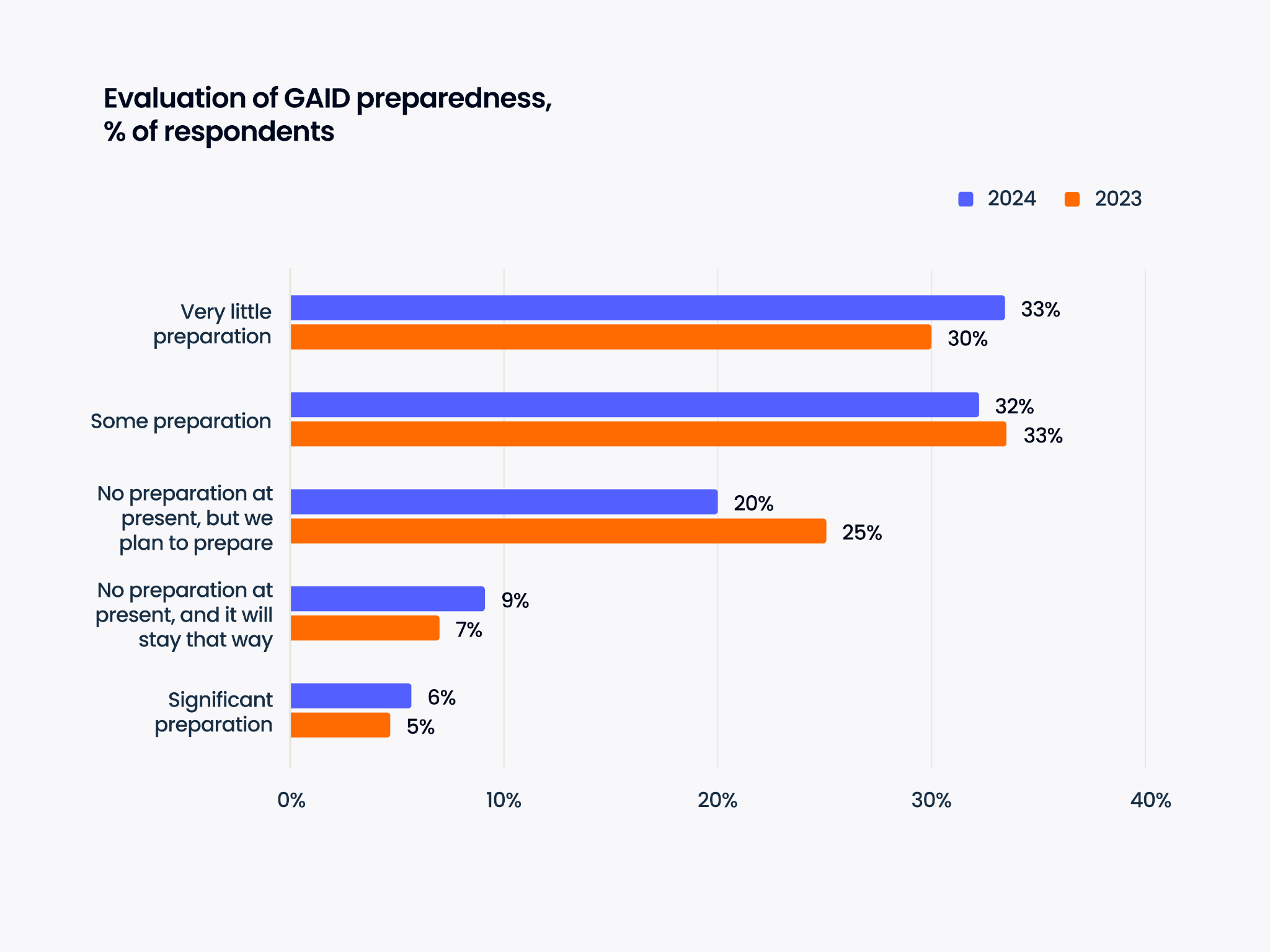

Marketers are less familiar with GAID (Google Advertising ID), which is set to be deprecated to enhance user privacy, similar to Apple’s ATT (App Tracking Transparency). Over one-third of respondents said they’ve done very little to prepare for GAID, with a further 9% saying they have no plans to prepare.

Finally, last year was a major one for generative AI, with the technology beginning to impact multiple industries. Creative production and optimization are the main areas where it’s made a difference in mobile app marketing, listed by over half of all survey respondents. Lower down the ranks were development and coding (15%) and business operations (12%), suggesting it’ll be a while before we see widespread adoption of the technology.

Looking ahead to the future

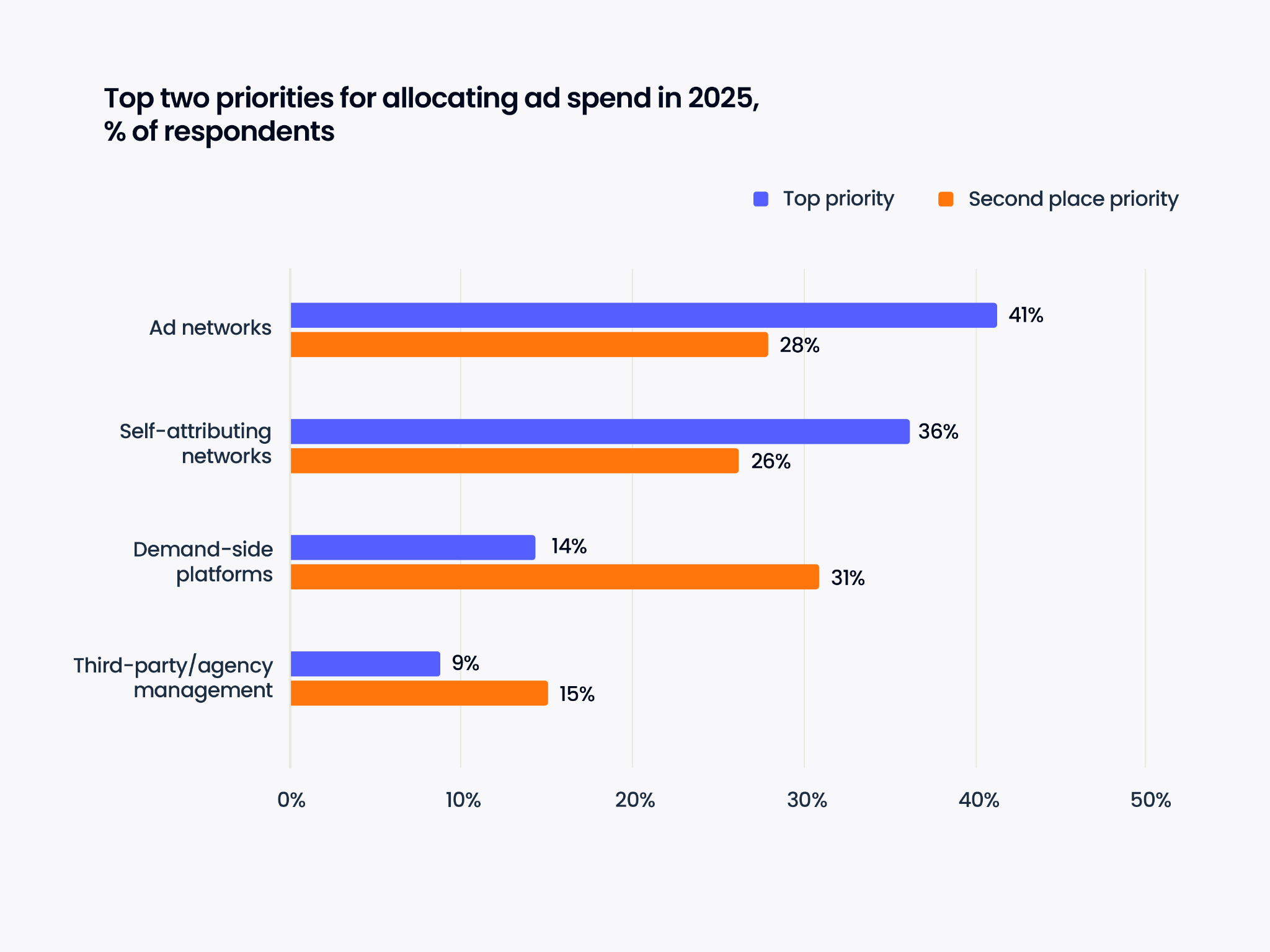

This year’s App Marketers Survey results suggest that most marketers feel the industry is heading in the right direction. 80% of respondents feel that things will be the same, if not better, in 2025 than they were in 2024. Just over 60% of respondents also stated that they intend to spend more, with most marketers citing ad networks and self-attributing networks as their top ad spend priority for mobile user acquisition (UA).

Looking beyond mobile UA channels, the survey results show that over 60% of marketers plan to invest in influencer and organic channels, and a little less than a third plan to focus on community building. About 20% of respondents also cited more traditional advertising methods, such as television (including CTV) and out-of-home advertising (such as billboards and posters).

Finally, mobile marketers are becoming more open to collaboration and coming together to face their challenges. For example, 56% of marketers stated they had begun working with new partners throughout 2024—an increase of 14% compared to 2023. This was primarily to improve return on ad spend (ROAS), reach new audiences, and expand their regional growth.

Taken together, the findings from this year’s survey point to an industry that’s maturing—shifting from high-velocity growth to more thoughtful, sustainable strategies. Marketers are adapting to new technologies, evolving privacy frameworks, and shifting consumer behavior with resilience and creativity. While challenges remain, there’s a sense of cautious optimism and a strong willingness to collaborate, innovate, and grow—smarter and stronger—in 2025.

Marketing Technology News: RMNs Aren’t Enough: How to Meet Shoppers Where They Are