Hearsay Systems Deepens Salesforce CRM Integrations to Improve Financial Services-Focused Customer Experiences; Announces Investment from Salesforce Ventures

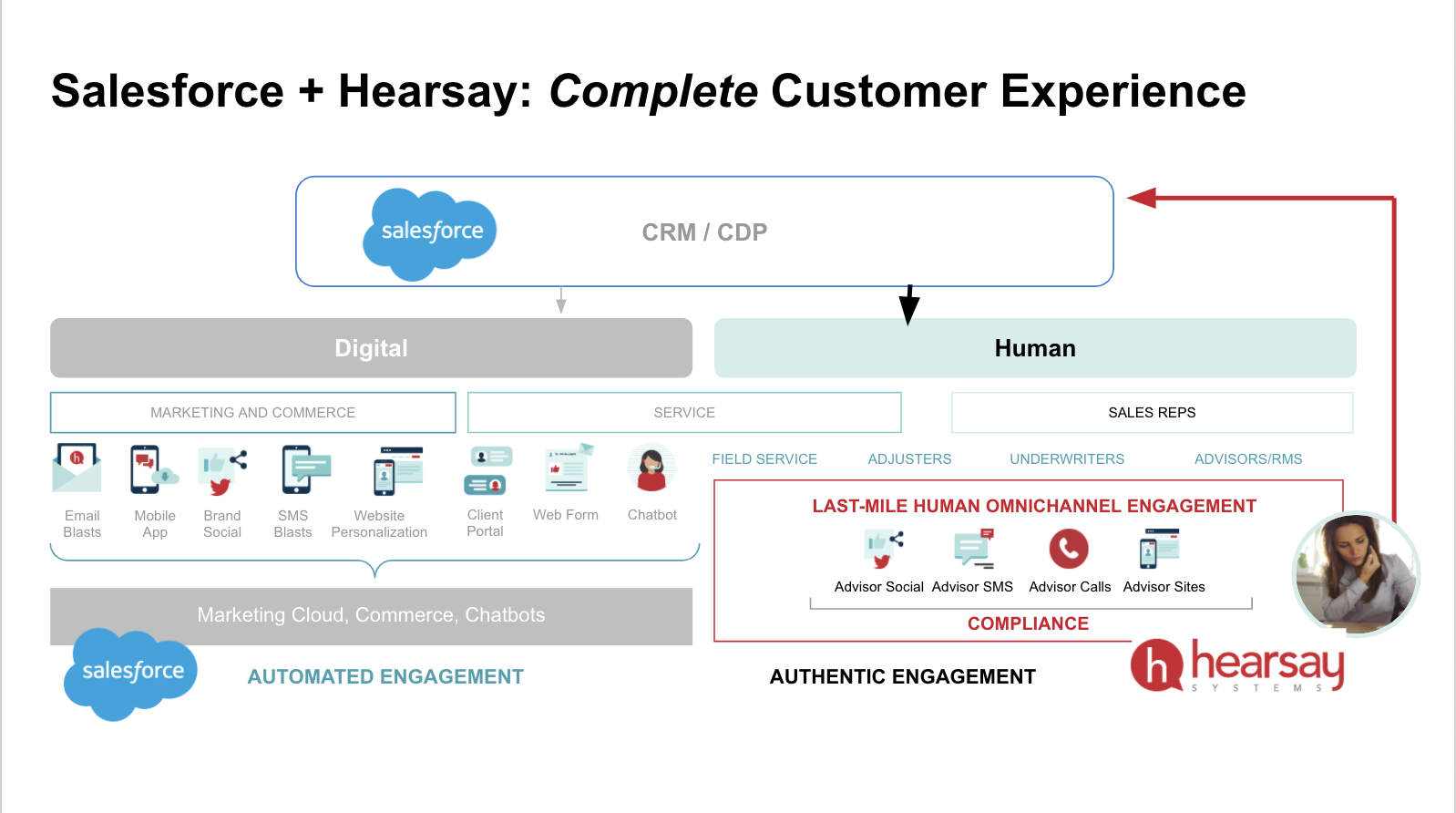

Salesforce CRM integrations have been driving the last mile customer experience management demands for various industries. In a major announcement from the Salesforce economy, last-mile CDP company for the financial services Hearsay Systems has announced a strategic Salesforce partnership. The new-age CDP – Cloud CRM partnership will further empower Marketing and Customer Communications executives in handling complex interactions with users.

Why a CDP Should be on your MarTech Shopping List

The Salesforce-based CX Management integration is expected to boost Hearsay Systems’ product line, enabling the Product Management team to drive actionable data insights and allowing critical field-level interactions to be automatically captured in CRM and CDP systems.

Why Hearsay Chose Salesforce?

Salesforce is one of the most preferred Marketing and Commerce Cloud platforms. In recent times, it has refined its overall Marketing, Sales and Commerce automation integrations through the Salesforce AppExchange marketplace, even as it acquired some of the biggest data science companies in the last 5 years such as Tableau. Earlier this year, Salesforce acquired Evergage. Together with its partners and vendors, Salesforce continues to hold the key to leveraging AI, Machine Learning, Automation and Blockchain for marketing, sales, customer experience, and communications technology industry.

How Brands Mimicking Consumer Behavior Is Crucial to Getting Ahead of Ad Fraud

Hearsay provides compliant, regulation-ready social media, voice, text, and website solutions that extend the power of Salesforce to wealth management, banking, insurance, and home lending customers.

Hearsay Systems chose Salesforce to upgrade its CDP offerings for the financial services sector. In a COVID-19 era, traditional in-person sales interactions and meetings have been totally disrupted. Owing to social distancing norms, sales teams are finding it extremely difficult to understand and analyze customer demands — who, are equally struggling to find a product or service of their liking and budget. In such a scenario, Hearsay Systems’ decision to partner with Salesforce aims at making sales reps from advisors, mortgages and insurance agents at financial services companies more human-centric using technologies. As a matter of fact, Hearsay Systems acknowledged that the customers are choosing service providers based on how quickly they help sales reps from the financial services sector to connect quickly, easily, and compliantly with clients during a period of economic uncertainty.

The partnership will encompass stronger product integrations, allowing insights from advisor activities to be captured in Salesforce, thereby providing visibility into omnichannel advisor-client conversations that are happening in the field across compliant text messaging, mobile calls, social media, and advisor websites.

Hearsay has already seen a 300% spike in client engagement activity across their platform, including a 50% surge in texting volume between advisors and clients since the start of the pandemic.

It has also reported that Hearsay product utilization increases 3X during pandemic across digital communication channels between advisors and clients.

The Future of Martech and SalesTech in COVID-19 World: Any Guesses?

Demand for compliant, last-mile digital communication channels for financial firms is soaring amidst the new socially distanced reality.

Together, in unison, Martech and Salestech are proving to be the backbone of every industry. Never before have we witnessed a more centralized unification of marketing and sales technologies. This is true especially in the frontline sectors affected by the pandemic such as healthcare, financial services, security and wireless network / telecom management…

Taking a specific example from the fintech sector, Salesforce and Hearsay will continue to reinvent the advisor-client experience in wealth management, home lending, property and casualty, and life insurance by allowing advisors and agents to authentically and intelligently grow business relationships by proactively guiding and capturing the last mile of digital communications.

Along with increased usage of these digital communication channels (eNews, Video, Social, SMS and Voice), the demand for integrations of CRM and other core systems with last-mile client engagement has nearly doubled. These integrations result in up to 10X volume of last-mile activities captured in CRM, providing critical context to inform next best actions.

Financial services providers are utilizing advanced CRM and Call analytics tools to enhance customer focus by simplifying communications through text messaging, video chats, and email notifications. These channels integrate with Salesforce CRM.

Today, financial advisors think are working as partners and guides to customers who are unable to make complex financial decisions, especially when the fears around man-made recession or pandemic depression are causing havoc. They not only act as approachable authorities but also as a trusted partner.

Salesforce CRM and Hearsay Systems’ partnership manages the entire customer experience journey, from the first interaction to the last mile, with seamless CRM integration.

At the time of this announcement, Bill Patterson, EVP and General Manager, Salesforce CRM said,

“Hearsay’s last-mile customer engagement platform is a natural addition to our Salesforce applications. With a growing set of regulations introduced across industries, organizations need to ensure that their sales, service, and marketing teams follow compliant communications with customers. With Hearsay, we are excited to deliver these enhanced capabilities to Salesforce customers.”

Today, Hearsay serves more than 170,000 advisors and agents at the world’s largest financial services firms including Allstate, Ameriprise, Farmers Insurance, HSBC, Morgan Stanley, Northwestern Mutual, and Prudential.

Clara Shih, CEO of Hearsay Systems said, “The first phase of digital for banks and insurers was automated engagement– mobile apps and push notifications, email automation, ad targeting. Now, especially in the pandemic, financial services customers are demanding authentic engagement with their financial advisors, bankers, and insurance agents. Customers want the speed and convenience of digital combined with the empathy and trust of their relationship manager. Salesforce’s 360-degree view of the customer, workflow, and analytics plus Hearsay’s compliant last-mile engagement together deliver the human client experience at scale which advisors and customers want and need now more than ever.”