In December 2018, Square declared it would re-file regulatory paperwork to run a banking business.

In December 2018, Square declared it would re-file regulatory paperwork to run a banking business.

“Square Capital is uniquely positioned to build a bridge between the financial system and the underserved,” said Jacqueline Reses, head of Square Capital.

Square is not the only merchant point-of-sale (POS) company attempting to sway apothecaries and farm stands alike away from commercial banks. Companies leveraged targeted social media campaigns to build relationships with small businesses, and show they could offer more than POS. Facebook, in particular, is used to target and position key players as business partners. Discrete creatives from key merchant marketers increased more than 60% in the second half of 2018. This increase in creative versions aligned with offer variety and content series for small business owners. Companies promoted everything from inventory management, to working capital, to content series with curated advice.

Major banks, notably Bank of America, did not take this development sitting down. Bank of America shifted its branding November 2018 to align itself more closely with entrepreneurship and small businesses nationwide. This creative increase was also observed in Bank of America’s merchant advertising on Facebook.

Read More: Eye Rolls at Pre-Rolls: How to Escape the Trap of Annoying Ads

Message strategies from newer players are diverse and compelling, but titans such as Bank of America are innovating to stay in the game. The value proposition itself is less important than assuring merchants they have a trusted partner who can handle all their business needs.

Bank of America emphasized its merchant services tenure. Content marketing fueled social media strategy; Bank of America touted its experience to provide free content with tips for new small business owners.

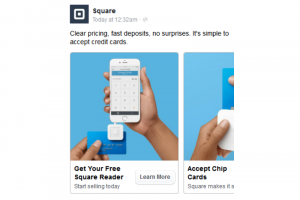

Square’s Madlibs-esque ad copy evoked a hassle-free solution. Simple graphics and straightforward language tell any merchant on the prowl for a POS partner that Square will make their lives easier.

PayPal used targeted paid Facebook ads to showcase the breadth of its business support; from startup loans to mobile payment options to its Business in a Box kit. PayPal used variety to convince business owners they need not look elsewhere.

ShopKeep led with its low credit card processing fees and free advice content series. The newer entrant postures claims of reliability against Square. ShopKeep had the fewest creatives, which is unsurprising as they grow brand recognition and establish a social media presence.

Newer entrants and banks alike should market all aspects of their merchant services beyond processing fees, and curate a healthy dose of free, helpful content. Customer experience and support go a long way to build trust. Merchant services marketing is no exception.

In 2019, we’d predict more 1:1 consultation marketed through social media. In particular, on-site support, expert advice and seminar series. We also expect to see an increase in easy tools, such as inventory checklists, festival dos and don’ts, and onboarding guides.

Read More: 3 Ways Mobile Technology is Changing the Brick-and-Mortar Experience